Why Debt Consolidation Is a Boon for Startup Businesses

Does the dream of being self employed and having your own business drive you crazy? Are you ready to forgo the life of relaxation and enjoyment to pursue your dream that can be realized only through hard work, perseverance and a lot of sacrifice? If your answer is yes to both the questions, you have the true spirit of an entrepreneur, who is ready to take up the challenges of starting a business. From where to start the journey may be in your mind, but first and foremost you should know well that you need funds to trigger all activities that lead to the startup process. It may not be easy to find investors for shelling out money in your endeavor that is fraught with several risks. Therefore, you have to take loans and credits from wherever available to finance the project.

The lure of Las Vegas

What has been described above is a typical startup scenario that you might come across in places even like Las Vegas. The city that is well known for its pomp and extravaganza of elite lifestyle made famous by its numerous casinos and attractive nightlife. Las Vegas has now turned out to be an equally attractive destination for businesses. The high point of attraction is that it is a round the clock city that never sleeps. The opportunities of business are not constrained by defined times that multiplies the attraction for investors. It is also economical to start up business in the downtown area of the city that offers reasonable and affordable space for business and accommodation.

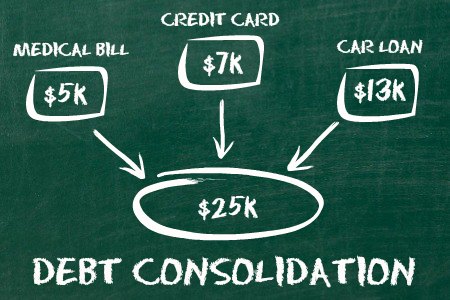

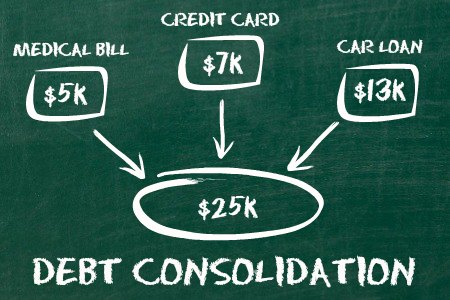

Seeking debt consolidation

The money collected through several credits and loans for business may not always be easy to pay back for various reasons. The conditions that had prevailed during the initial phase of business might change suddenly due to economic reasons or market conditions. Effectively, the business might face a slowdown. Dwindling sales and rising costs can make things worse on the financial front. It can make it difficult for you to service the loans and make timely payments as the business goes under strain. In order to keep the business afloat, it is imperative to seek actual debt consolidation meaning, where all loans are merged into a single loan that becomes easy to manage while paying back several other creditors.

Whiff of fresh air

Post debt consolidation it would feel like you are again able to breathe in fresh air. The professional advice of debt consolidation companies are providing a fresh lifeline for businesses that are financially throttled by multiple loans. The new loan that is taken can be paid back within a period of 1 to 5 years and can be availed at a lower interest. Stretching the loan might result in quashing the advantage of low interest as you finally pay back much more.

Debt consolidating companies are now available online to assist business owners with the most practical solution for carrying on with debts without compromising the business goals. Business startup can now be more confident in tackling the financial risks without jeopardizing the business.